401k contribution tax deduction calculator

Strong Retirement Benefits Help You Attract Retain Talent. Ad Discover The Benefits Of A Traditional IRA.

Pin On Personal Finance

This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

. If your marginal tax. The maximum contribution amount that may qualify for the credit is 2000 4000 if married filing jointly making the maximum credit 1000 2000 if married filing. Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income.

Learn About 2021 Contribution Limits Today. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Build Your Future With a Firm that has 85 Years of Retirement Experience. MAGI limits if youre covered by a retirement plan at work. When you make a pre-tax contribution to your.

Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. This calculator has been updated to. Ad Discover The Benefits Of A Traditional IRA.

Your tax brackets as a single taxpayer as of the 2021 tax year would be. Personal Investor Profile Download. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Definition of a 401k Account. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings. If your business is an S-corp C-corp or LLC taxed as such.

Pre-Tax Savings Calculator Enter your information below Tax Year 2022 Filing Status Annual Gross Income prior to any deductions Itemized Deductions If 0 IRS standard deduction. You can use the Table and Worksheets for the Self-Employed Publication 560 to find the reduced plan contribution rate to calculate the plan contribution and deduction for. This calculator helps you estimate the earnings potential of your contributions based on the amount you invest and the expected rate of annual return.

You only pay taxes on contributions and earnings when the money is withdrawn. Learn About 2021 Contribution Limits Today. Select a state to.

State Date State Federal. Solo 401 k Contribution Calculator. Your tax owed will be reduced by the contributed amount multiplied by your marginal tax rate.

10 on income from 0 to 9950 12 on income from 9951 to 40525 22 on income from. Plan For the Retirement You Want With Tips and Tools From AARP. Use this calculator to see how increasing your contributions to a.

Estimate Salary Paychecks After Required Tax Deduction 401K or 403B Contributions Free 2022 Employee Payroll Deductions Calculator Use this calculator to help you determine the impact. Ad Maximize Your Savings With These 401K Contribution Tips From AARP. This calculator is designed to show you how you could potentially increase the value of your retirement plan account by increasing the amount that you contribute from each paycheck.

Retirement plan at work. Use this calculator to see how increasing your. Use this contribution calculator to help you determine how much you will have saved in your 401k fund when you retire.

Take the IRA Deduction calculator for the current tax year and see what portion of your contributions can be deducted. Many employers provide matching contributions to your account which can range from 0 to 100 of your contributions. Plus many employers provide matching contributions.

Your 401 k contributions will lower your taxable income. Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

Traxpayroll Solutions Traxpayroll Solutions Payroll Software Filing Taxes

Solo 401k Contribution Limits And Types

Can You Get A Tax Deduction For Your 401 K Smartasset

Solo 401k Contribution Limits And Types

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

After Tax 401 K Contributions Retirement Benefits Fidelity

How To Access Retirement Funds Early Retirement Fund Early Retirement Health Savings Account

Let S Talk Taxes Infographic It S A Money Thing Kalsee Credit Union Tax Money Tax Money

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

After Tax Contributions 2021 Blakely Walters

After Tax 401 K Contributions Retirement Benefits Fidelity

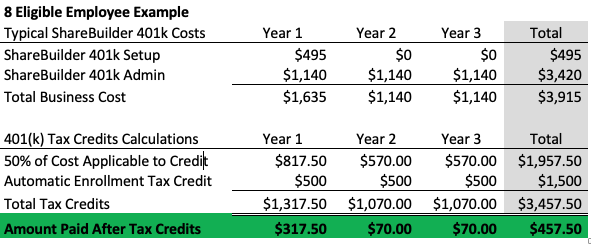

The Secure Act Allows For Up To 16 500 In Tax Credits For Small Business 401 K Plans Sharebuilder 401k

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

Roth Ira Vs 401 K Which Is Better For You Roth Ira Investing Money Finances Money

The Ultimate Roth 401 K Guide District Capital Management

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

Roth Ira Vs 401 K Which Is Better For You Roth Ira Roth Ira Investing Ira Investment